- Blog

- How to Import a Car to Croatia

How to Import a Car to Croatia?

This step-by-step guide walks you through importing cars to Croatia as a trader. You’ll learn about the required documentation, fees, and regulations to comply.

As the used car industry continues to grow across Europe, used car dealers have an opportunity to tap into the Croatian market.

If you’re running a dealership and want to import used cars from the EU into Croatia, you’ll need to ensure your business is fully compliant with local regulations.

This guide will walk you through the essential steps to make the process as smooth (and profitable!) as possible.

Get to know the Croatian used car market

Before you start importing, you might want to analyze the market so that you know what cars to import, and in what quantities.

After all, overstocking and understocking vehicles is among the biggest mistakes that new dealerships make, so you should carefully plan to avoid these pitfalls.

Although 2020 hit Croatia with a decline in both new and used car registrations, the market has made a strong recovery by 2024. Focus2move reports that the Croatian passenger car market is now growing rapidly, with June 2024 alone seeing a 13.3% in car registrations.

Overall, sales in 2024 have risen by 14.4%, making Croatia one of the top-performing markets in Europe.

Now that you’re aware of the market trends, let’s take a look at which best-selling brands you might want to consider stocking.

In 2024, new car registrations in Croatia looked like this, with these top-selling brands leading the market:

- Skoda: 5,444 cars registered

- Volkswagen: 4,324 cars registered

- Renault: 3,076 cars registered

- Opel: 2,672 cars registered

- Toyota: 2,498 cars registered

- Suzuki: 2,475 cars registered

- Dacia: 2,085 cars registered

- Hyundai: 1,880 cars registered

- Kia: 1,788 cars registered

- Audi: 1,436 cars registered

Essentially, you can’t go wrong with stocking evergreens like Volkswagen, Skoda, and Renault. These brands are consistently popular and have a strong track record in the Croatian market.

When it comes to particular models, focus2move reports that the Skoda Octavia continues to be the most popular choice, followed by the Opel Corsa and Renault Clio.

Skoda Octavia

So, you shouldn’t rush to stock your lot with exotic cars—it seems that Croatians prefer familiar, reliable brands.

And if you want to import models that match Croatian market preferences, you should consider importing second-hand cars from Germany, Belgium, and the Netherlands, as these countries offer reliable cars that are familiar to your local buyers.

Import regulations of Croatia

A key part of importing cars into Croatia is the homologation process (“homologacija”). This step ensures the car meets all EU regulations for safety and emissions before you can legally drive it in the country.

You can homologate the car you’re importing in certified technical inspection stations across the country.

Ideally, you’ll bring the COC (Certificate of Conformity) to the homologation. If you can’t get the certificate for the used car you’re importing, then you’ll need to provide the manufacturer’s certificate or technical specification of the vehicle as an alternative.

You can see the list of testing sites on HAK’s official website and find one closest to you.

Documentation for importing vehicle as a business

Car traders have to prepare specific documents to import cars to Croatia. Here’s an overview of what you’ll need.

Bill of sale

Bill of sale serves as proof of ownership. This document shows that the sale happened and confirms the car’s value.

It contains information such as make and model, VIN (Vehicle Identification Number), purchase price, and the date of transaction.

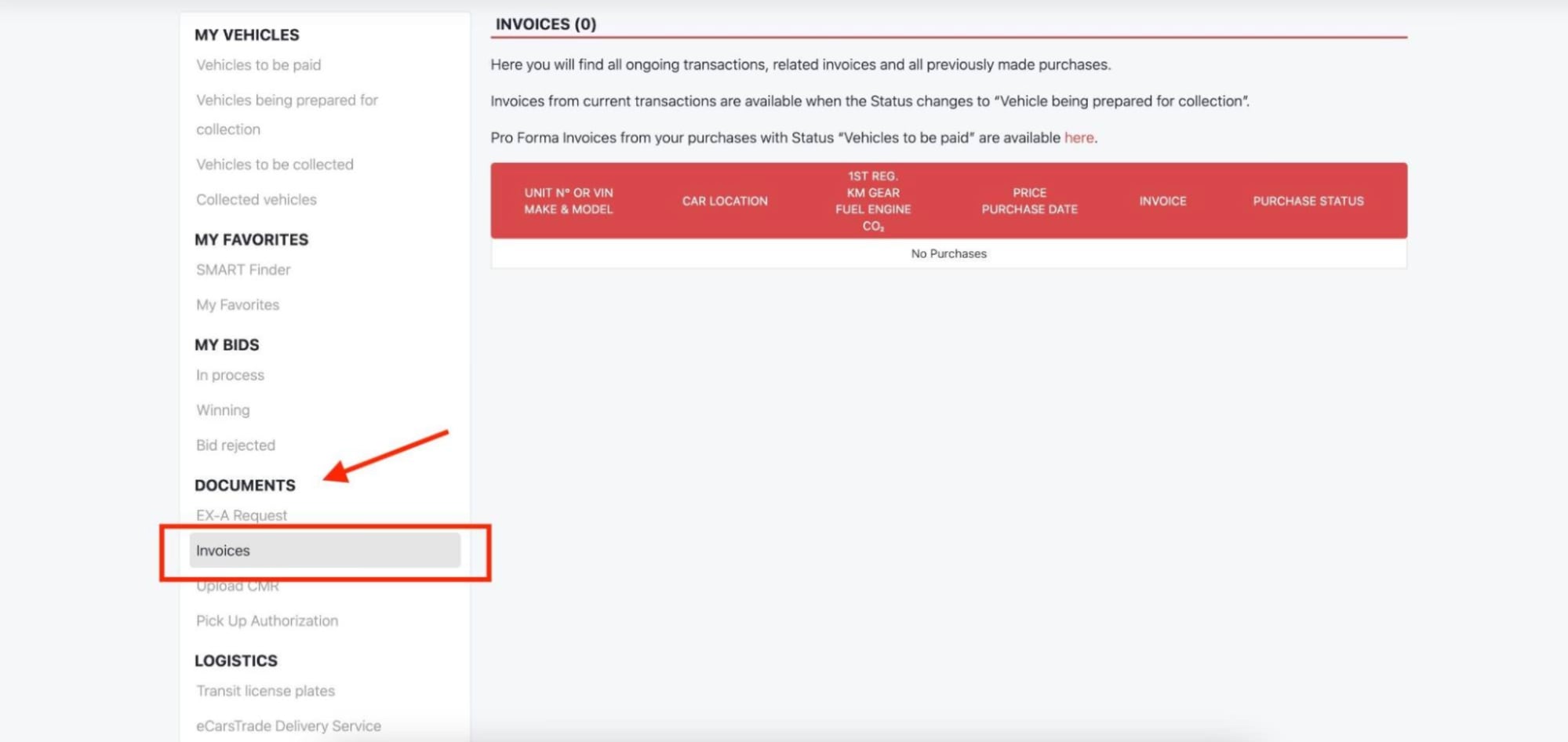

If you buy a car through eCarsTrade, you’ll get the bill via email. You can also find it on your Personal page on the eCT platform.

Important note: the bill of sale doesn’t have to contain the stamp or the signature of the seller and buyer. However, if you do provide the bill of sale that contains the stamp or the signature, then it has to be an original document, not a copy.

This little detail will help you save time when you bring the car to the technical inspection station, ensuring a smoother process.

COC (Certificate of Conformity)

The COC is a document issued by the vehicle manufacturer. It essentially certifies that the vehicle complies with the regulations required for it to be legally sold and registered within the EU.

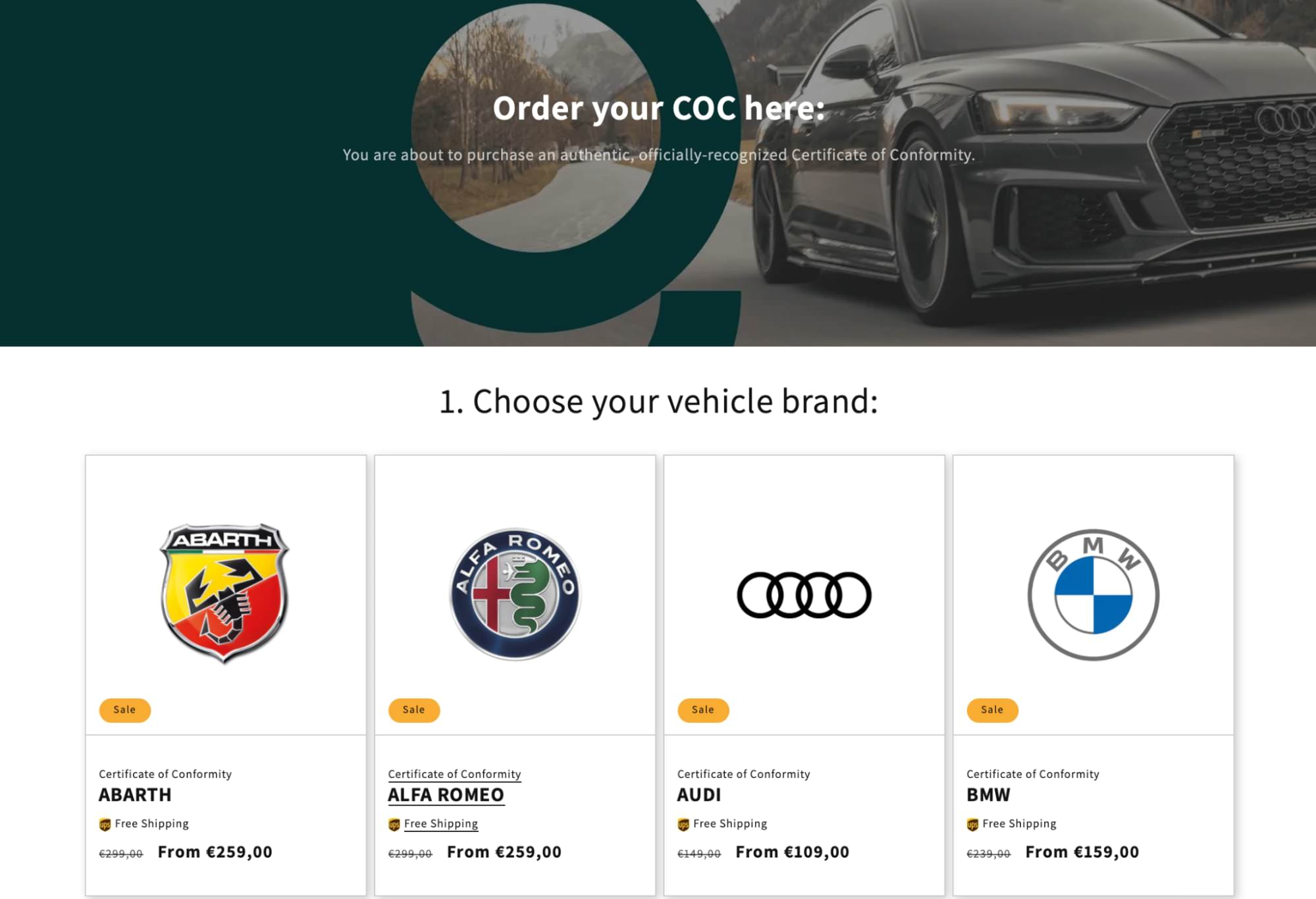

Depending on the country you’re importing from, your car may not come with the COC. That’s okay—you can buy one online. For instance, COC-Online lets you order authentic certificates which are then sent to you via post.

You can also get the COC at the same office where homologation is conducted, but this service comes with an additional fee.

Vehicle registration certificate

You’ll also need the vehicle registration certificate. The certificate is issued in the country where the vehicle was originally registered, and verifies that it was legally registered there.

Proof of insurance cover

When importing a vehicle into Croatia, you will need to provide proof of Compulsory Insurance within the transport sector.

The insurance is tied to the vehicle, not the owner, and it ensures that the vehicle is covered for liability while it’s being transported and after it is registered in Croatia.

You have to get the insurance from an authorized provider, and you should keep the proof of insurance handy during the import and registration process.

A letter of attorney + CMR form

This only applies if you’re hiring somebody else, like a transport agency, to deliver the car for you. In that case, you’ll need to compose a letter of attorney (also called a power of attorney) that authorizes the person or agency to act on your behalf during the import process.

The document grants them the legal right to handle tasks such as picking up the vehicle and transporting it.

Drafting the letter of attorney is easy, you only need to include the following essential details:

- Your full name and birth date: Clearly state your identity.

- Authorized person’s full name and birthdate: Identify the person or agency you are authorizing.

- Vehicle details: Make, model, and identification number of the vehicle.

- Authorized tasks: What they’re allowed to do, e.g. pick up the car.

- Location details: Where to pick up and deliver the car.

- Date and signature: Sign and date the document to make it legally binding.

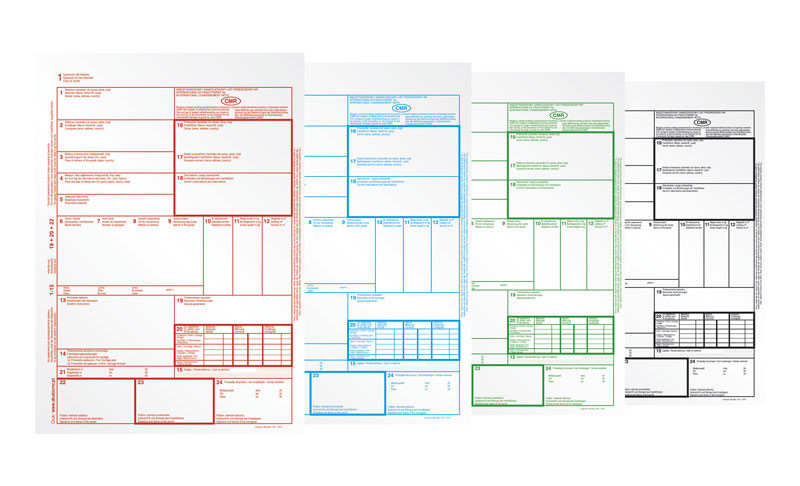

In case you’ve hired a transport company to deliver the vehicle to Croatia, you’ll also need a Consignment Note, also known as a CMR.

The CMR is crucial because it provides proof that the vehicle was handed over to the carrier for transportation. We’ve prepared an entire article about the CMR, so make sure you read it to see how it protects your interests during the transport process.

Keep in mind that Croatian law requires that no more than 15 working days pass between the date of purchase (as shown on the invoice) and the start of the customs process. So, it’s important to get all your documentation, including the CMR, ready and submitted on time to avoid any complications.

Taxes when importing a car to Croatia

There are several taxes you’ll face when importing a car to Croatia:

VAT

One of the main questions that car dealers ask is “Do I have to pay VAT when importing a car to Croatia?”

The answer depends on your specific situation.

As a dealer, you generally don’t have to pay VAT in Croatia if VAT was already paid in the country where the used vehicle was purchased.

However, if you’ve bought a car tax-excluded (without paying VAT in the country of purchase), you’ll have to declare and pay VAT in Croatia. The vast majority of cars on eCarsTrade come VAT excluded.

The VAT is charged at the standard rate of 25%, and it’s applied to the total value of the car, including the purchase price, transportation, additional equipment, and any other related costs.

The good news is that you can request a refund for the VAT paid in the country of origin once you’ve completed the customs process in Croatia and can prove the car has been imported. You usually have about 60 days to apply for this refund, which is managed by the finance ministry of the country where the VAT was initially paid.

Special motor vehicle tax (PPMV)

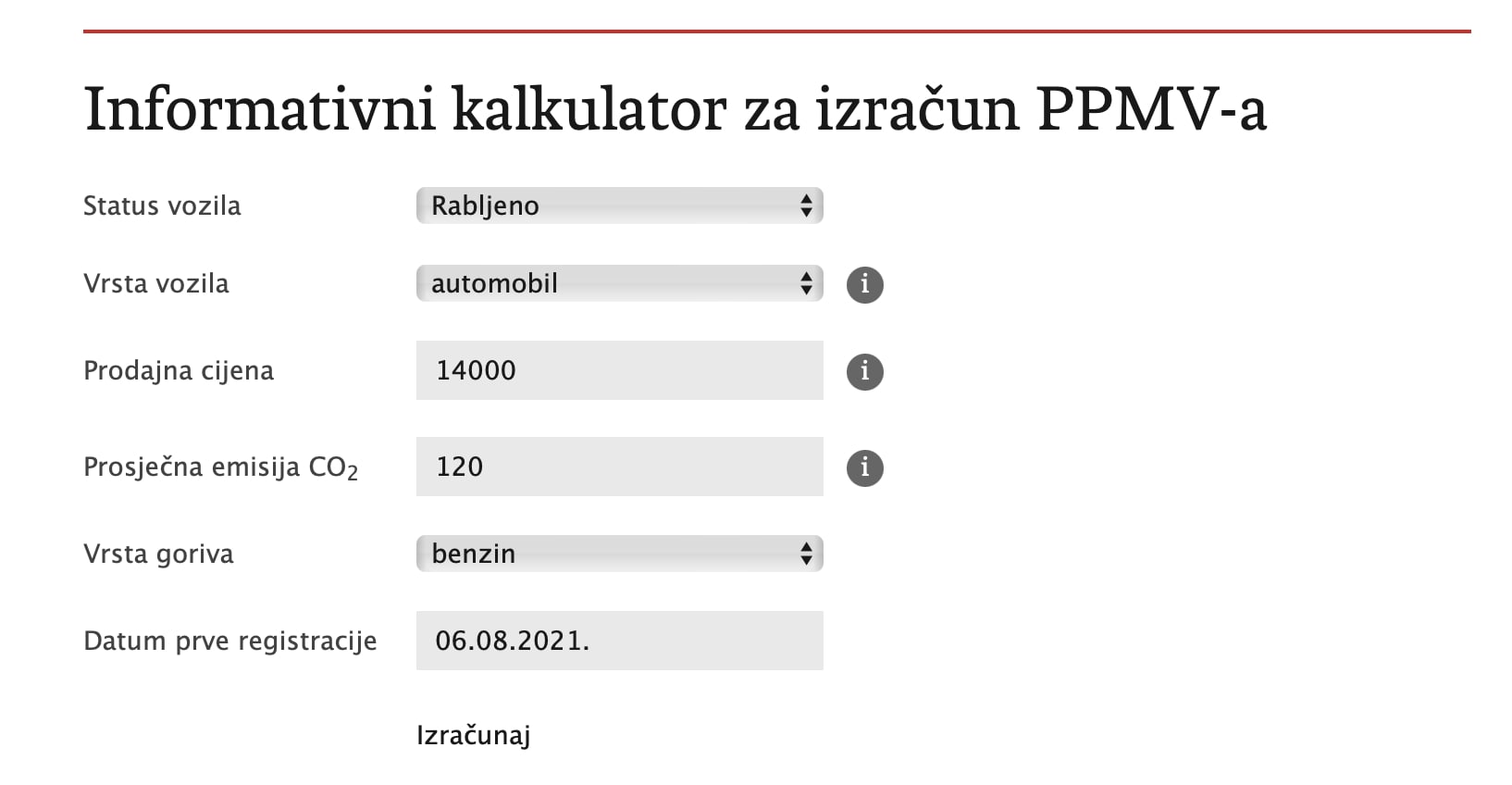

Croatia charges a special tax that’s applied to motor vehicles, and it’s called “Posebni porez na motorna vozila”. You’ll mostly see the acronym PPMV in use.

It’s calculated based on factors such as the vehicle’s age, fuel type, and CO2 emissions. The official Customs Administration of Croatia offers an online calculator that you can use to estimate the amount of PPMV you’ll have to pay.

The actual amount may vary, but this is a good way to get an estimate and eliminate surprises.

Electric vehicles are exempt from paying PPMV because they have no emissions. So, that’s a factor to consider if you’re looking to reduce import costs and make your dealership more eco-friendly.

Note that the Customs administration may use their official purchase price catalog to determine the value of the car you’re importing. The catalog lists vehicles by brand and model, with estimated prices provided for each calendar month from 2013 to the present.

You also have an option to take the vehicle to the Customs office for evaluation, and they’ll calculate the PPMV based on their assessment of the car.

Disposal fee

The disposal fee is another mandatory fee you’ll pay when importing a car to Croatia. Its amount is calculated based on the weight of the car and the number of tires.

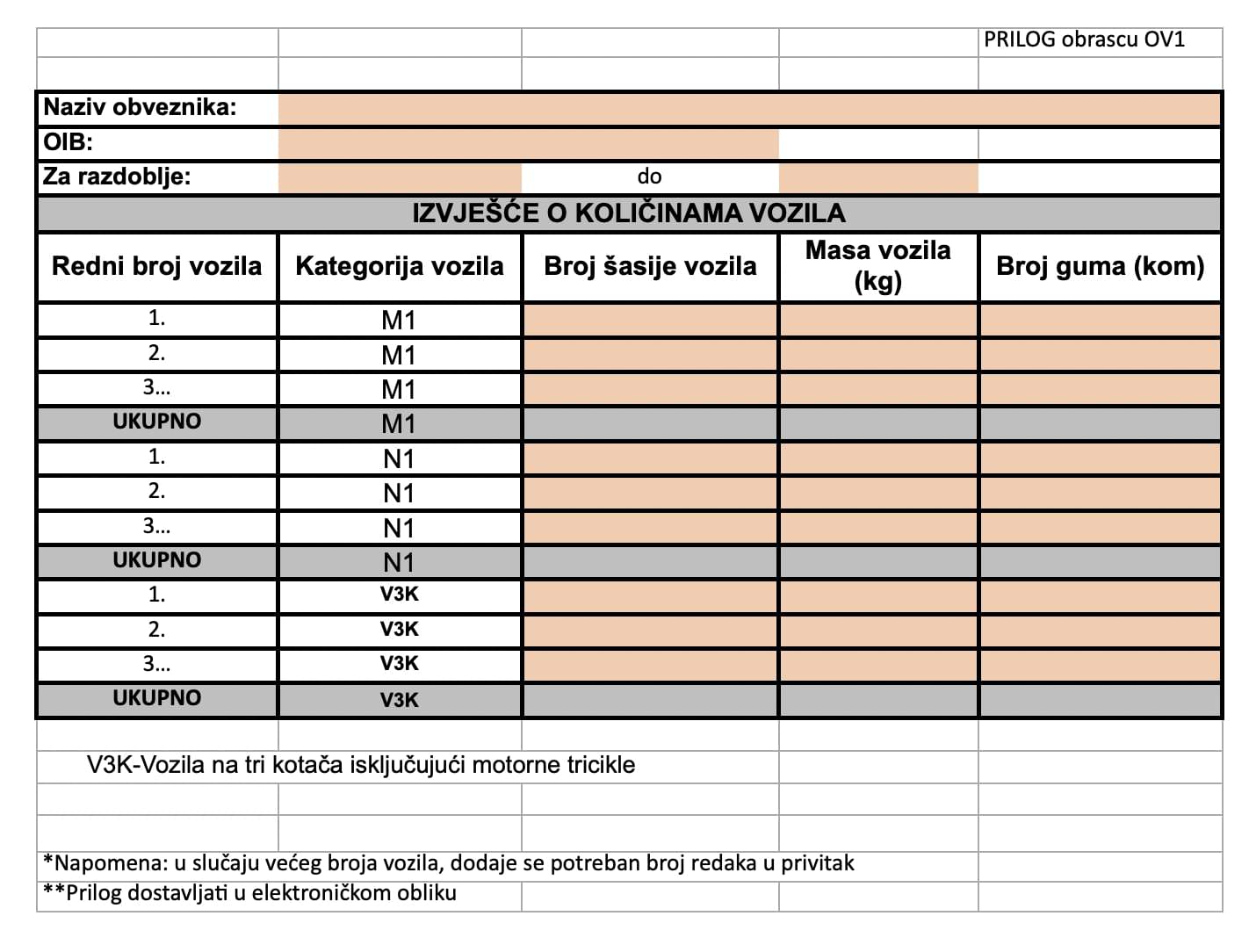

To calculate and pay this fee, you’ll have to fill in the OV1 form and the addition to the OV1 form, which you can see below.

The fee is calculated at a rate of 0.08 €/kg based on the weight of the car. For example, if you’re importing a Dacia Duster that weighs around 1,300 kg, the disposal fee would be approximately: 1,300 kg x 0.08 €/kg = 104 €.

Step-by-step process - from purchasing a car to importing it to Croatia

Alright, now that you know what documents you need to prepare for import, and what sorts of cars Croatians prefer, we’ll guide you through the step-by-step process of importing a car into Croatia.

1. Find and purchase the vehicle

Everything starts with finding the right vehicles for the Croatian used car market. You can explore a wide range of options on eCarsTrade, our platform that lets you buy quality vehicles via auctions or at fixed prices.

When you buy cars on eCarsTrade, we’ll also deliver all available car documentation, so that you have one less thing to handle during import.

2. Arrange transportation and prepare transitional plates

The second step is transporting the vehicle. Transporting cars between dealerships is the easiest when you hire a car transport company.

You can also opt for the eCarsTrade Delivery Service and we will organize the transport of your vehicles for you within the European Union. Your parking just has to be reachable by a transport truck, and we’ll do the rest!

3. Gather the documentation

Let’s review the documents you’ll need before the car arrives in Croatia:

- Bill of sale

- COC

- Vehicle registration certificate

- Proof of insurance cover

- A letter of attorney (if someone else is handling the import for you)

- CMR (if you’re shipping the car by road transport)

4. Pay VAT

If the car was bought without paying VAT in the country of origin, you’ll need to declare and pay VAT in Croatia. The standard rate in Croatia is 25%, and it’s applied to the total value of the car.

5. Pay the PPMV and the disposal fee

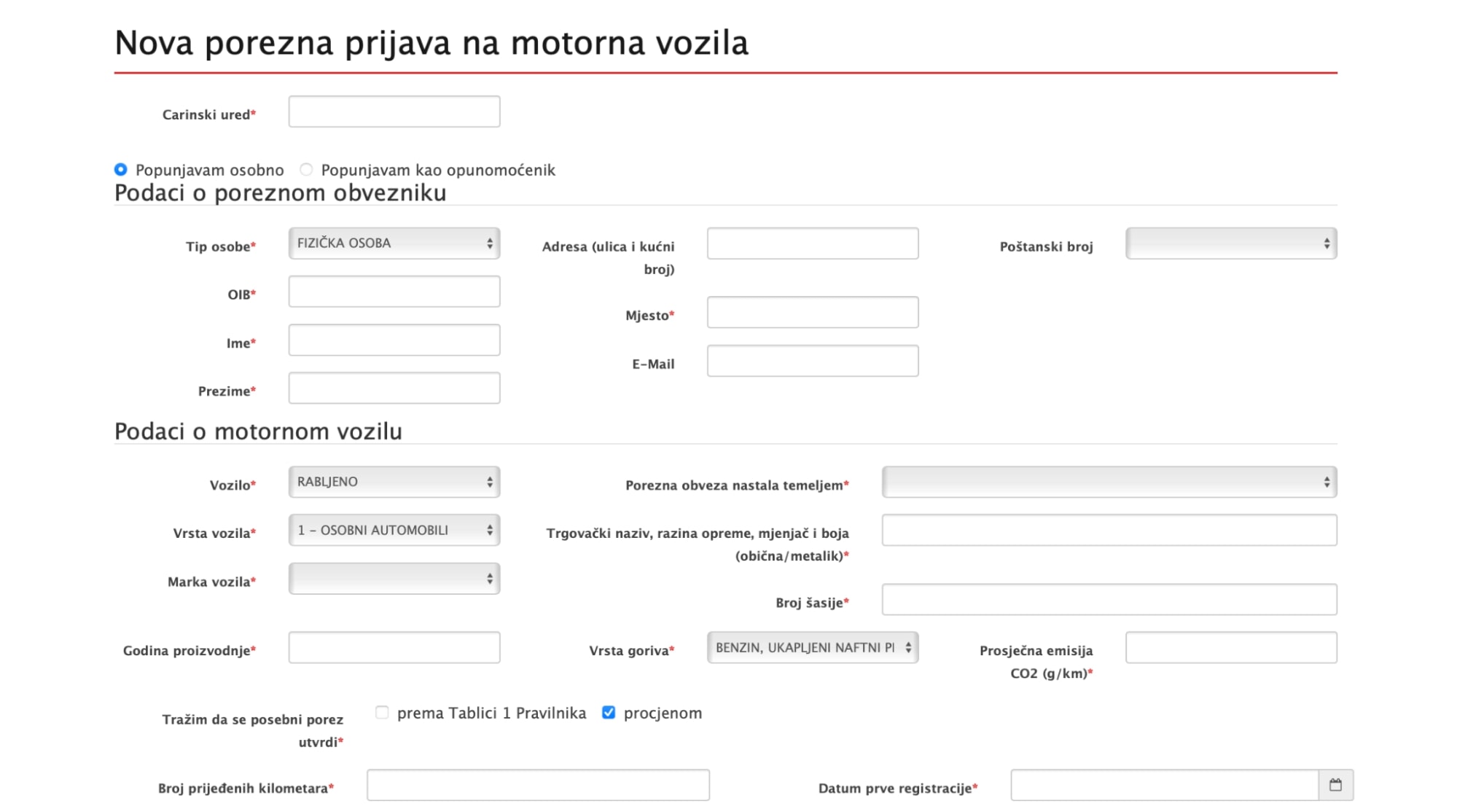

When the car is imported, you’ll have to pay the PPMV. You can do that in person or online.

Image source: eCarina

Remember, the PPMV amount will be determined either based on the official purchase price catalog or the vehicle’s evaluation at the Customs.

Once you fill in the PPMV application, you’ll receive two documents. One lists the PPMV amount and payment instructions, and the other one outlines the disposal fee. This means you can handle both fees in one step.

6. Homologate the car

The process is done at your chosen technical inspection station. There, they’ll take pictures of your car and make copies of the documents you bring.

7. Pass the technical inspection

While you’re at the inspection station, your car will also go through technical inspection.

8. Register the car and pay the registration

After you pass the inspection, your final step is registering the car with the Ministry of the Interior of the Republic of Croatia.

Luckily, since 2018, you can handle the registration at your technical inspection station, meaning that you can take care of homologation, technical inspection, and registration all in one place.

Importing a car to Croatia - FAQ

► Do I have to pay customs duty when importing a car from an EU country?

No, you don’t have to pay customs duty if you’re importing a car from another EU country. Customs duty only applies to vehicles imported from outside the EU.

► Can I drive the car in Croatia before it’s fully registered?

Yes, but you’ll need temporary transit plates. These plates are usually obtained in the country where you bought the car and are valid for a limited time of up to thirty days.

► Can eCarsTrade import the car for me?

eCarsTrade is here to help you find and purchase the right vehicles for your dealership, but we do not handle the import process directly. However, there are agencies that specialize in managing the entire import process, and we recommend collaborating with them so that everything goes smoothly.

► Has anything changed for importing cars from the EU after Croatia joined the Schengen Area?

While you still have to pay the PPMV and other fees, transporting cars across borders has become easier because there are no more border checks between Schengen countries.

All you need to know about car import to Croatia

Fact: importing a car to Croatia may seem like a bureaucratic feat.

Also a fact: sourcing cars internationally can boost the success of your Croatia-based dealership because you can offer a wider range of high-demand vehicles, often at better prices. This means that you can stand out in the local market and build a reputation as the go-to dealer for quality and variety.

We hope that this guide has made the import process easier and given you the confidence to import cars successfully!

Importing vehicles from Europe can be complex, but eCarsTrade is here to simplify the process. Learn how to: