- Blog

- Tesla Car Sales in Europe - 2025 & The Future

Tesla Car Sales in Europe - 2025 & future

Tesla sales declined in Europe in 2025 despite growing EV demand. See what happened, how BYD compares, and what it means for car dealers.

When people think about electric cars, Tesla is often one of the first brands they think of.

After all, Tesla has been one of the most influential electric vehicle brands in Europe over the past decade.

However, that has changed in 2025, at least in terms of the number of sales. EV adoption kept growing in several EU markets, but Tesla sold fewer cars in Europe than the year before.

To clarify the situation, we’ll look at the decline of Tesla’s sales in Europe, how the brand compares to competitors like BYD, and what the trends might mean for used car dealers.

Tesla Europe sales in 2025

We’ve heard so much about the drop in Tesla sales, and it’s not just rumors.

Registration data across Europe shows a clear fall compared to earlier.

Let’s look at the total numbers and sales in different countries to see how precisely Tesla performed.

Performance vs previous years

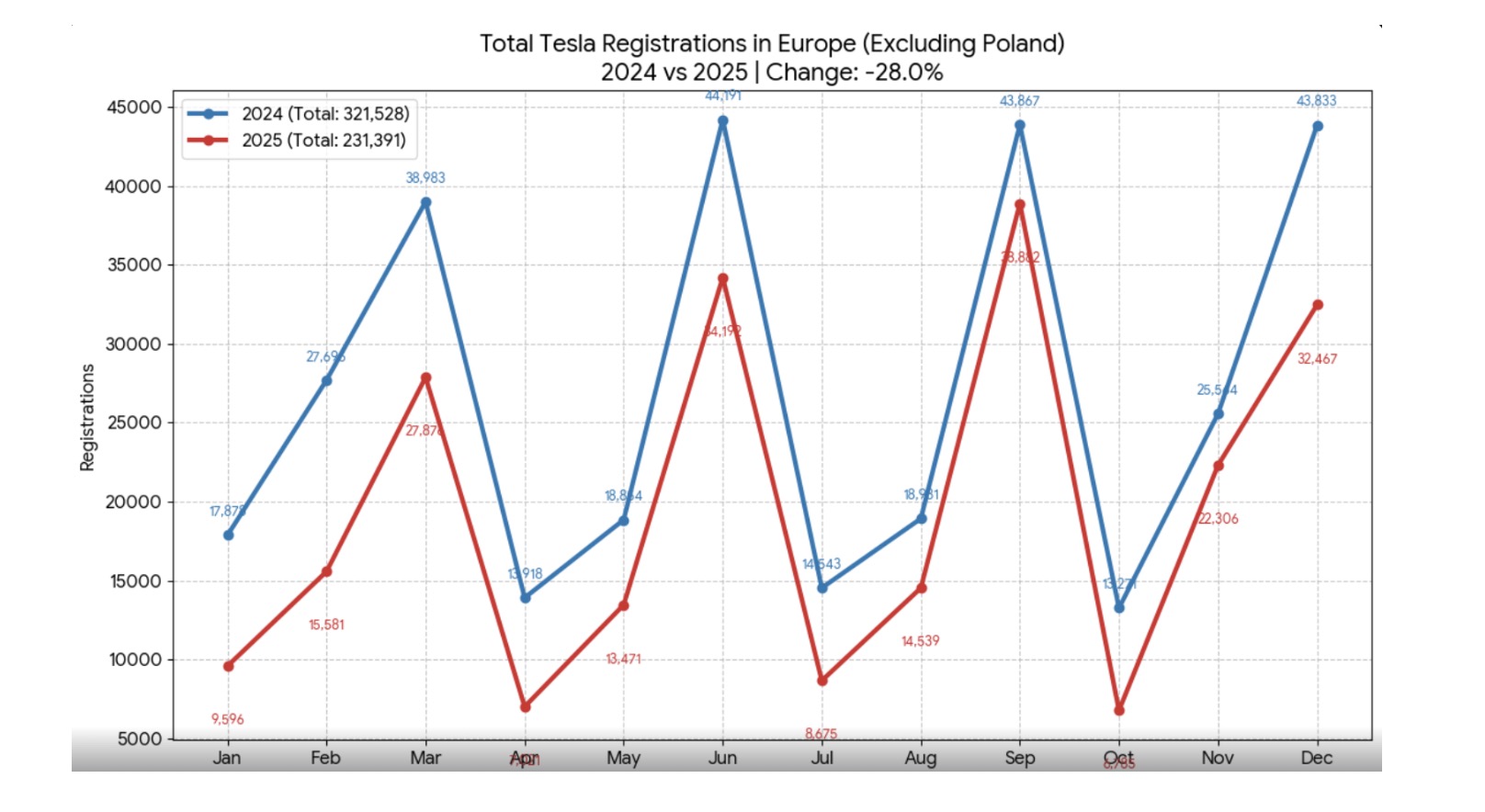

Tesla’s European sales declined noticeably in 2025 compared to 2024.

Based on monthly registration data for several European markets (excluding Poland), Tesla sales declined by around 28%.

Source: Electrek

Source: Electrek

If you’re interested in the number of cars, that’s a drop from 321,500 vehicles in 2024 to about 231,400 in 2025.

It’s important to note that this decline hasn’t happened because the EV market is shrinking. The opposite happened.

According to ACEA, battery-electric cars made up 17.4% of all new EU car registrations in 2025, up from 13.6% in 2024.

So, the problem is not in the demand for EVs, it’s that many buyers chose other brands instead of Tesla.

Best European markets for Tesla sales

Overall sales may have dropped, but Tesla is still sold in a small number of European countries.

For instance, Germany and the Netherlands were Tesla’s largest European markets by volume in 2025.

Note that Tesla registrations were lower by almost half in both Germany and the Netherlands in 2025 compared to 2024.

Still, the sheer amount of EV registrations in Germany and the Netherlands means Tesla can sell meaningful volumes there even in a weaker year.

Let’s also mention Norway. Although it’s not part of the EU, it’s one of Tesla’s strongest markets in Europe.

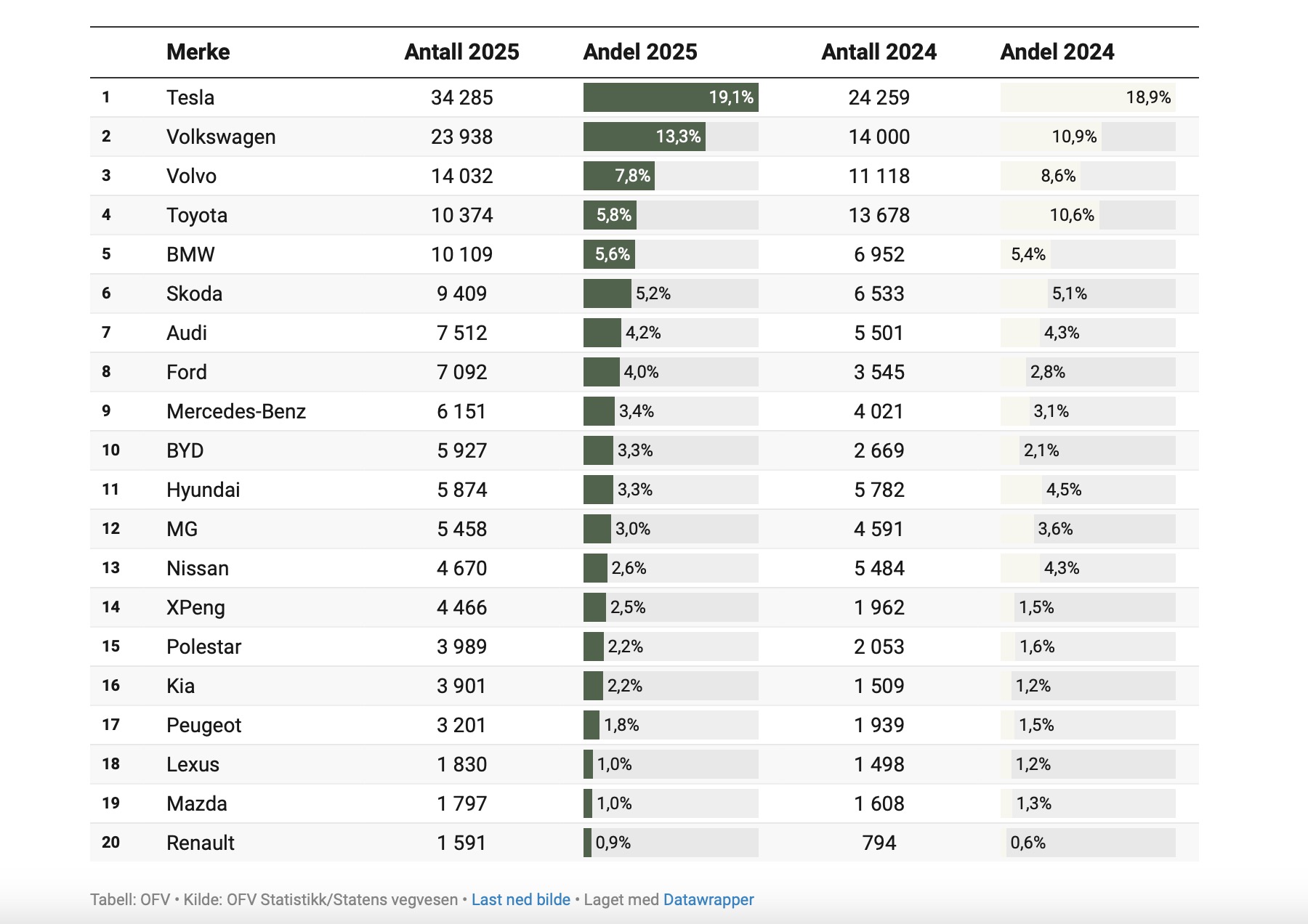

As opposed to most other markets, Tesla’s sales increased in Norway in 2025 compared to 2024. In fact, Tesla was the best-selling car brand in there, with 34,285 registrations and a market share of 19.1%.

Below, you can see the top-selling car brands in Norway in 2025, with Tesla in first place.

Source: OFV

Source: OFV

So, if you want to see where Tesla is still strong in Europe, Norway is a good example.

Worst-performing markets for Tesla in 2025

As we’ve seen, Norway was a clear exception, with Tesla sales rising there. In most other European markets, Tesla sales fell.

The list of the markets where Tesla declined includes:

As you can see, these decreased sales happened in different parts of Europe, so it was not just one local market issue.

Tesla vs BYD: Battle for the EU market

While Tesla struggled in Europe in 2025, Chinese EVs continued to grow.

For instance, BYD is one of the brands that increased sales the most.

According to The Wall Street Journal, Tesla had 238,656 registrations in Europe in 2025, while BYD recorded 187,657 registrations in the same year.

So, Tesla still had more registrations than BYD in Europe in 2025, but the difference became much smaller.

These numbers suggest that Tesla is no longer competing only with premium EV brands, but with brands like BYD that focus on lower prices and higher volumes.

Why did Tesla sales collapse in Europe?

EV sales are increasing, while Tesla sales specifically are decreasing. Why is that? Let’s see the main reasons that could be behind the drop.

► Factor #1: Stronger competition, especially from Chinese brands

BYD outsold Fiat and Seat in France, Seat in Italy, and Fiat in Spain, which shows how quickly BYD’s registrations increased in Europe.

If you add other Chinese brands to the mix, EV buyers simply have more choice in many price ranges, which makes it harder for Tesla to stand out the way it did a few years ago.

► Factor #2: Not enough diversity in models

Declining sales aside, Tesla in Europe relies mostly on Model Y and Model 3 as its core models.

Other EV makers usually offer more body styles and price options, so buyers can more easily find an alternative that fits their budget or needs.

Some claim that Tesla’s approach is a way to stay competitive without total redesigns, but lower registrations in 2025 suggest that this strategy isn't too successful in today’s European EV market.

► Factor #3: Public perception around Elon Musk

Some reports also link Tesla’s decline in Europe to the political controversy around Elon Musk.

It’s hard to measure this effect directly, but it may have influenced how some buyers feel about the brand.

Tesla’s response - different strategy or model adjustments for the EU market?

Now, let’s see what Tesla has to say about the situation.

So far, Tesla’s response in Europe looks less like a new model strategy, and more like a focus on software and approvals.

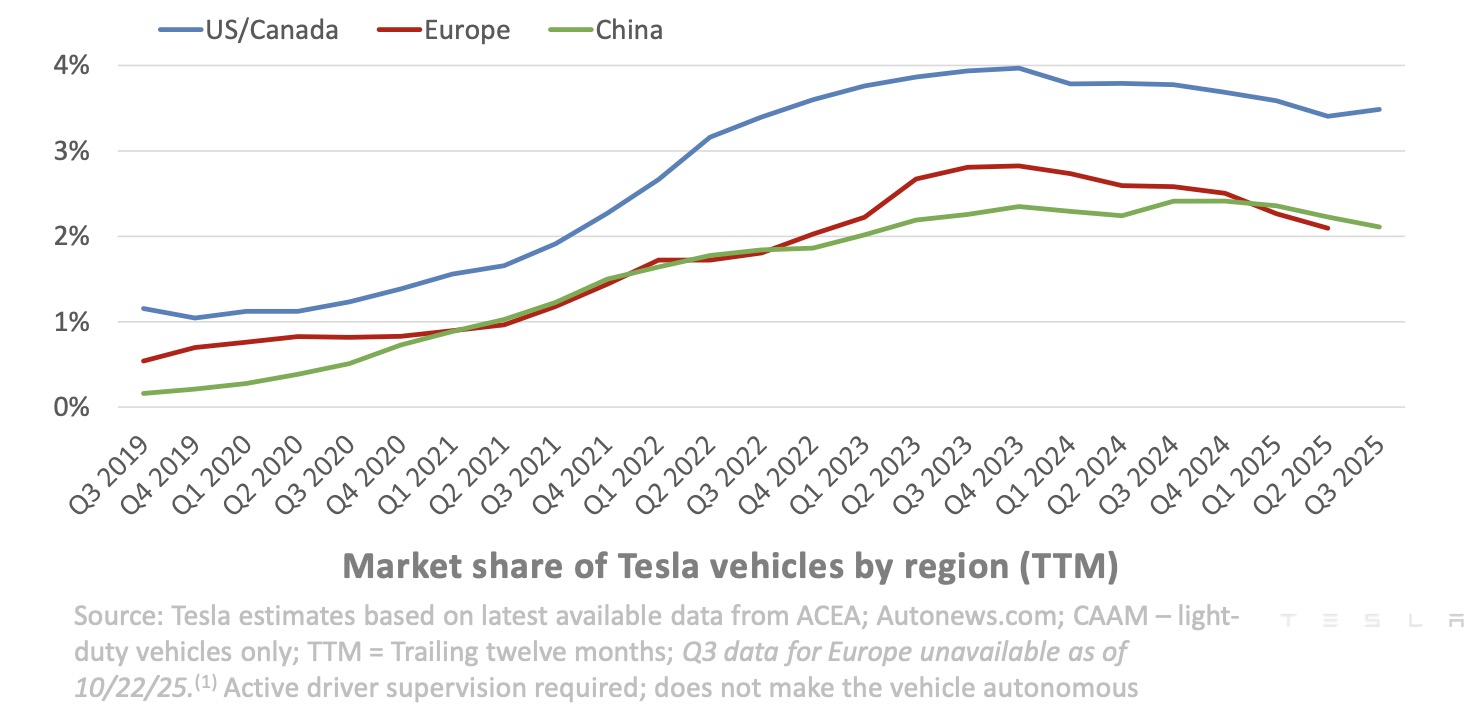

In its Q3 2025 Update, Tesla included a chart showing its market share by region, and it shows that Tesla’s market share in Europe and China was lower in 2025 compared to its earlier peak.

Source: Tesla

Tesla leadership has also discussed Europe directly on its earnings calls. Here’s a direct quote from the Q2 2025 earnings call that you might find interesting:

“It’s worth noting that we do not actually yet have approval for supervised FSD in Europe. We think our sales in Europe will improve significantly once we are able to give customers the same experience that they have in the US.”

It seems like the Tesla leadership believes that full self-driving (FSD) might be the key to increasing sales in Europe, once that’s approved by regulations.

Still, that may be hard to achieve in practice. Many drivers are careful with new driving features, and it took years for EVs to become widely accepted in Europe.

So, FSD may not boost Tesla’s sales in Europe right away.

Long-term impact on the Tesla market in Europe

Tesla’s 2025 decline might mean that Tesla is no longer an automatic choice for European EV buyers.

Because there are now other brands on the market, Tesla may need one of these elements:

- Better pricing

- More model updates

- Features that buyers can’t get in other brands

If not, Tesla’s sales might stay low in the next few years.

Tesla sales forecast for 2026

2026 forecasts are mixed.

Reuters reports that some Wall Street estimates expect Tesla sales to be about 8% higher in 2026.

On the other hand, Morgan Stanley expects Tesla sales to be about 2.5% lower in 2026.

There’s no clear agreement on where 2026 is going for Tesla, so we’ll watch out for quarterly reports.

What does this mean for car dealers?

If you trade used EVs, Tesla can still be a good brand to stock.

But you should treat it like any other EV now, because many buyers no longer choose Tesla just because it’s Tesla.

Tesla’s slowdown in Europe may also mean that there will be more used Tesla cars on the market, often sold at lower prices.

And since there’s demand for Tesla in some regions, you can sell these cars well if you source them carefully and price them realistically.

FAQ

► Which European countries had the worst Tesla sales decline?

France, Sweden, and Denmark had some of the largest declines in 2025 compared to 2024.

► Did Tesla sales drop in all European countries?

No. Norway was an exception, but sales fell in most other countries.

► How does BYD compare to Tesla in Europe now?

BYD is still behind Tesla in total 2025 European registrations, but the difference is much smaller than before.

► Which EV was the best selling in the EU in 2025?

Although Tesla sold fewer cars overall, the Model Y was still the best-selling EV in Europe in 2025, and the Model 3 was also near the top. These models are still among the best EV models for dealers to stock.

► Should dealers invest in used Tesla inventory?

Yes, but be selective. Tesla can still sell well in some regions, but many buyers now compare it directly with other EV brands.